Social Security benefit max rises to $4,018 monthly

The Social Security benefit maximum rises to $4,018 monthly, influenced by factors like lifetime earnings, claiming age, and spousal benefits, making strategic planning essential for optimizing retirement income.

Social Security benefit max rises to $4,018 monthly, a significant change that could impact your financial planning. Have you thought about how this might affect your retirement savings? Let’s dive into what this increase means for you.

Understanding Social Security benefits

Understanding Social Security benefits is crucial for individuals planning their financial future. These benefits serve as a financial foundation for many seniors and can significantly impact their retirement lifestyle.

What are Social Security benefits?

Social Security benefits provide income for retired workers, people with disabilities, and survivors. Funded through payroll taxes, this government program aims to support those in need. Knowing how these benefits work can help you make informed decisions.

How are benefits calculated?

The calculation of benefits is based on your earnings history. The more you earn and contribute to Social Security during your working years, the higher your monthly benefits will be. It’s essential to understand how the benefit formula works:

- Your average indexed monthly earnings (AIME) help determine your benefits.

- The Social Security Administration uses your top 35 earning years to calculate your AIME.

- Adjustments for inflation ensure that benefits maintain their purchasing power over time.

Moreover, fields like your age when you decide to claim your benefits also play a critical role. Opting for benefits early might lead to reduced monthly payments. Each month you delay claiming can increase your benefits. This decision requires careful planning and consideration.

You should also be aware of other factors impacting benefits, such as spousal benefits and survivor benefits. Spouses can access benefits based on their partner’s earning record, potentially increasing their monthly payment. Researching these options is important for maximizing your benefits.

Factors influencing benefit amounts

Several factors influence benefit amounts in the Social Security system, making it essential for future beneficiaries to understand these elements. Knowing how they impact your benefits can help you plan better for retirement.

Work history and earnings

Your work history and earnings play a significant role in determining your benefits. The Social Security Administration (SSA) looks at your highest 35 years of earnings to calculate your monthly benefit. If you consistently earn more, your benefits will increase. In contrast, years with low income can decrease your overall average, leading to lower payments.

Aging and claiming age

The age at which you decide to claim your benefits also affects the amount you receive. You can start your benefits as early as age 62, but doing so can reduce your monthly payments by up to 30%. If you delay claiming until after your full retirement age—between 66 and 67 for most—your benefits will increase by approximately 8% each year.

- Claiming early means reduced benefits.

- Delaying increases the monthly amount.

- Full retirement age varies based on birth year.

Other factors, like whether you continue working while claiming benefits, can also impact your situation. Earning above a certain limit may temporarily reduce your Social Security benefits, which is important to consider if you plan to work during retirement.

Strategies to maximize your Social Security

Maximizing your Social Security benefits requires careful planning and strategic decisions. By understanding the options available to you, you can ensure that you receive the most out of this essential financial resource.

Delay claiming benefits

One of the most effective strategies to increase your monthly payments is to delay claiming benefits. For every year you wait beyond your full retirement age, your benefits can increase by about 8%. This can make a significant difference in your financial situation during retirement. It’s important to consider your health and financial needs when deciding the best time to start claiming.

Consider spousal benefits

Another key strategy involves spousal benefits. If you are married, you may be eligible for benefits based on your spouse’s earnings record. This can help you secure a higher monthly amount, especially if one spouse has significantly higher lifetime earnings.

- Review both partners’ earnings records.

- Claim strategies can vary depending on your spouse’s age.

- It might be beneficial to work together to maximize both individuals’ benefits.

Additionally, make sure to stay informed about how working while receiving Social Security can affect your benefits. If you choose to work before reaching full retirement age, your benefits may be reduced if you earn above a certain limit. However, once you reach that age, you can earn any amount without losing benefits.

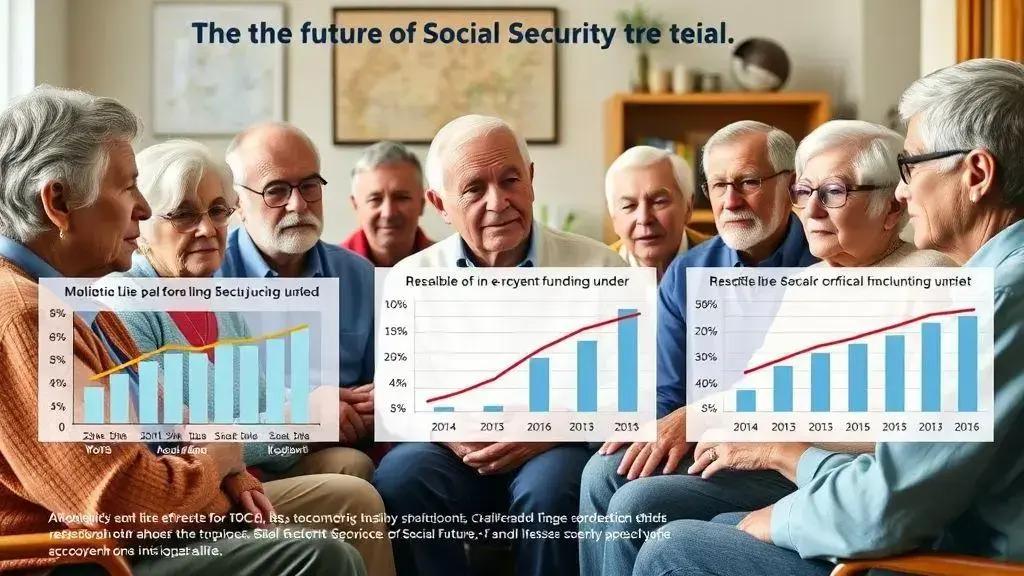

Future of Social Security and retiree impact

The future of Social Security is a topic of great interest and concern for many Americans. As the population ages, more retirees will rely on this crucial program. Understanding potential changes can help you prepare for what lies ahead.

Projected funding challenges

As more baby boomers retire, there are increasing concerns about the funding of Social Security. The system is primarily funded through payroll taxes, which means fewer workers supporting more retirees could lead to funding shortages in the coming years. Experts predict that by the mid-2030s, Social Security might only be able to pay about 76% of scheduled benefits if changes are not made.

Potential reforms

To address these funding challenges, several reforms are being discussed. These reforms might include:

- Increasing the retirement age to reflect longer life expectancies.

- Adjusting the payroll tax rate to raise more revenue.

- Modifying the way benefits are calculated to slow their growth.

Changes like these could significantly impact future retirees. It’s essential to stay informed and be proactive in planning for retirement. Understanding the implications of these potential reforms will help you make decisions about when and how to claim your benefits.

Given these concerns, planning for your retirement now is more critical than ever. Investing in other retirement savings options, like 401(k)s or IRAs, can provide added security beyond Social Security. Awareness of the long-term sustainability of the program and various strategies can help you adapt to the evolving landscape of retirement planning.

FAQ – Frequently Asked Questions about Social Security Benefits

What is the maximum Social Security benefit I can receive?

As of 2023, the maximum Social Security benefit is $4,018 per month, depending on your earnings and the age at which you start claiming benefits.

How can I increase my Social Security benefits?

You can increase your benefits by delaying your claim past your full retirement age, considering spousal benefits, and working longer to increase your earnings record.

What happens if I work while receiving Social Security benefits?

If you work while receiving benefits before reaching full retirement age, your benefits may be reduced if you earn above a certain limit. After full retirement age, you can work without penalty.

How is my Social Security benefit amount calculated?

Your benefit amount is calculated based on your highest 35 years of earnings, adjusted for inflation, and the age at which you claim your benefits.